Examining Tenant Screening Technologies

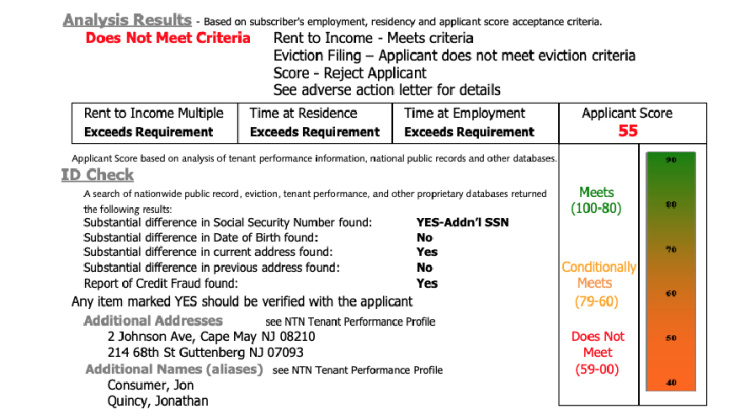

Screenshot from OpenTSS: Countering Tenant Screening

Over the past two decades digitized tenant screening, the use of web scraping, data collection, and third-party data brokers to create profiles of potential tenants, has become a dominant method for landlords to evaluate whether to rent to a prospective tenant. Despite the growing prevalence of digital tenant screening, the process and data sources used to inform results is opaque to researchers, policymakers, regulators, advocacy organizations, and the public. This opacity obscures high error rates and the perpetuation of racial inequality through the use of racially discriminatory data sources that do not accurately represent a prospective tenant and may be irrelevant to screening criteria.

In a comment to the Federal Trade Commission and the Consumer Financial Protection Board, a team of DUSP scholars define and map current digitized tenant screening services to improve understanding and create shared criteria to evaluate the issue. In their comment, the team identifies four key issues of concern: the parsing of tenant screening into a data or algorithmic problem; the data inputs and data types informing tenant screening services; the quantification of a prospective tenant through a proprietary algorithm, particularly for how it bends evaluators’ sense of objective or data-driven decisions; and the predatory nature of tenant screening services, specifically the imposition of fees and additional security deposits on tenants.

“It is crucial for us, as urban studies scholars, to engage and examine tenant screening technologies because the harms associated with low-income renters of color are understudied and yet ongoing. In particular, the unregulated recommendation and scoring system employed by numerous tenant screening services would pose a significant risk of perpetuating racial bias because landlords often perceive these recommendations and scores as objective indicators (which they are not). Through our efforts to understand and provide an evaluative framework, we saw policy pathways that the FTC and CFPB could implement now to hold tenant screening services accountable,” said Wonyoung So, a DUSP doctoral candidate who participated in the comments.

In addition to mapping out some of the key issues with and helping to create shared language for understanding tenant screening services, the team also provides a series of policy recommendations such as:

- Instituting a moratorium on tenant screening services until an auditing process has been developed;

- Creating and enacting a framework that accounts for disparate impact standards to counteract unconscious prejudices and disguised animus that are not easily classified;

- Establishing comprehensive data reporting and statistics to ensure effective and transparent analysis of disparate impact can be conducted;

- Requiring all tenant screening services to provide copies of reports to the prospective tenant they are evaluating so they can make informed decisions when applying for housing and potentially avoid multiple fees.

The team of authors include DUSP doctoral candidates Wonyoung So, Anisha Gade, and Chenab Navalkha with faculty members Catherine D’Ignazio and devin michelle bunten.

Learn more about So’s ongoing work investigating the confluence of tech and tenant screening